By Matt Reese, Meristem Crop Performance

I have spent the better part of my life talking with farmers about crop production and agronomy. Through those years I have yet to meet one farmer yearning for geopolitics to have a role of influence in the management of their operation. And yet, as the world grows smaller, global politics seem to loom ever larger in day-to-day decisions on American farms.

The recent U.S. and Israeli bombing of Iranian nuclear facilities had an immediate impact on the domestic economy, including costs associated with agricultural fertilizer.

“Iran is the third largest supplier of urea in the world. Israel already hit the main natural gas field that supports that production,” said Mark Purdy, Director of Product and Portfolio Management for Meristem Crop Performance. “Egypt is also a significant global supplier, and they source natural gas from Israel. Israel shut off that flow for current operation to mitigate targeting risk by Iran.”

Beyond this, any type of geopolitical uncertainty in the Middle East creates the potential for disruptions to the Strait of Hormuz and the supply chain of nitrogen, Purdy said. This adds further woes and increased freight costs amid already tight global supplies. Like it or not, those bombs in Iran had a global ripple effect through agricultural inputs that will ultimately reach the pocketbook of the American farmer.

Even before the incident, phosphorus prices were historically high and global fertilizer prices have been trending upward in 2025, eroding farmers’ purchasing power, according to a RaboResearch report this spring.

“RaboResearch’s fertilizer affordability index indicates a transition between cycles, moving from a period of relative affordability to one where fertilizers are less affordable and the index turns negative,” said Bruno Fonseca, senior analyst — farm inputs with RaboResearch. “We expect this unfavorable scenario for the fertilizer market to persist throughout the year…Farmers will struggle with reduced purchasing power for these nutrients, which may not immediately result in demand cuts in 2025, but the negative affordability index indicates such reductions will occur eventually.”

With the 2025 crop in the ground, farmers are looking at ways to minimize remaining nutrient costs this year and developing strategies for cost effective nutrient management for the 2026 crop. Fortunately, there are now more tools than ever to help farmers take back some control of their nutrient costs.

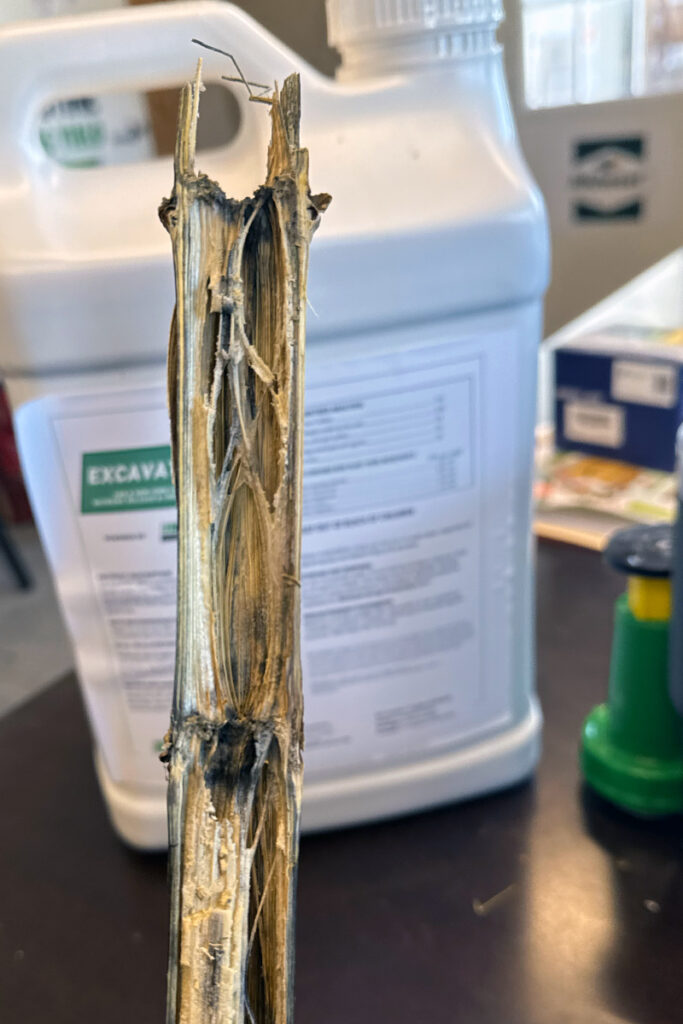

Advances with biological crop inputs are providing new options for efficient and effective on-farm nutrient management allowing farmers to cash into the nutrient bank already out in their fields. There are a number of recently released biological products — naturally derived and domestically processed and packaged — available for both providing the nutrients crops need in season through foliar applications and post-harvest applications of microbes to break down crop residue and unlock the nutrients it contains. Shifting focus to crop management systems that emphasize building soil health (such as reduced tillage with cover crops and the use of biologicals) can also help farmers navigate rising fertilizer costs for corn and soybean production and beyond.

With innovation, sound agronomics and new tools to better control their crop performance outcomes, farmers can hedge against the on-farm impacts of events completely out of their control, sometimes on the other side of the world. With a focus on what they can control, farmers can focus on farming and leave the geopolitics to the politicians.

Matt Reese coordinates Media & State Relations and serves as the Content Creator for Meristem Crop Performance based in Powell, Ohio. Contact him at 614-582-3641 or mreese@meristemag.com.

For more information, contact Mark Purdy at mpurdy@meristemag.com or 513-288-4634.

Back to Newsroom